social security tax limit 2021

The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2023 will be 9932 147000 x 62 and 9114 147000 x 62 in year. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

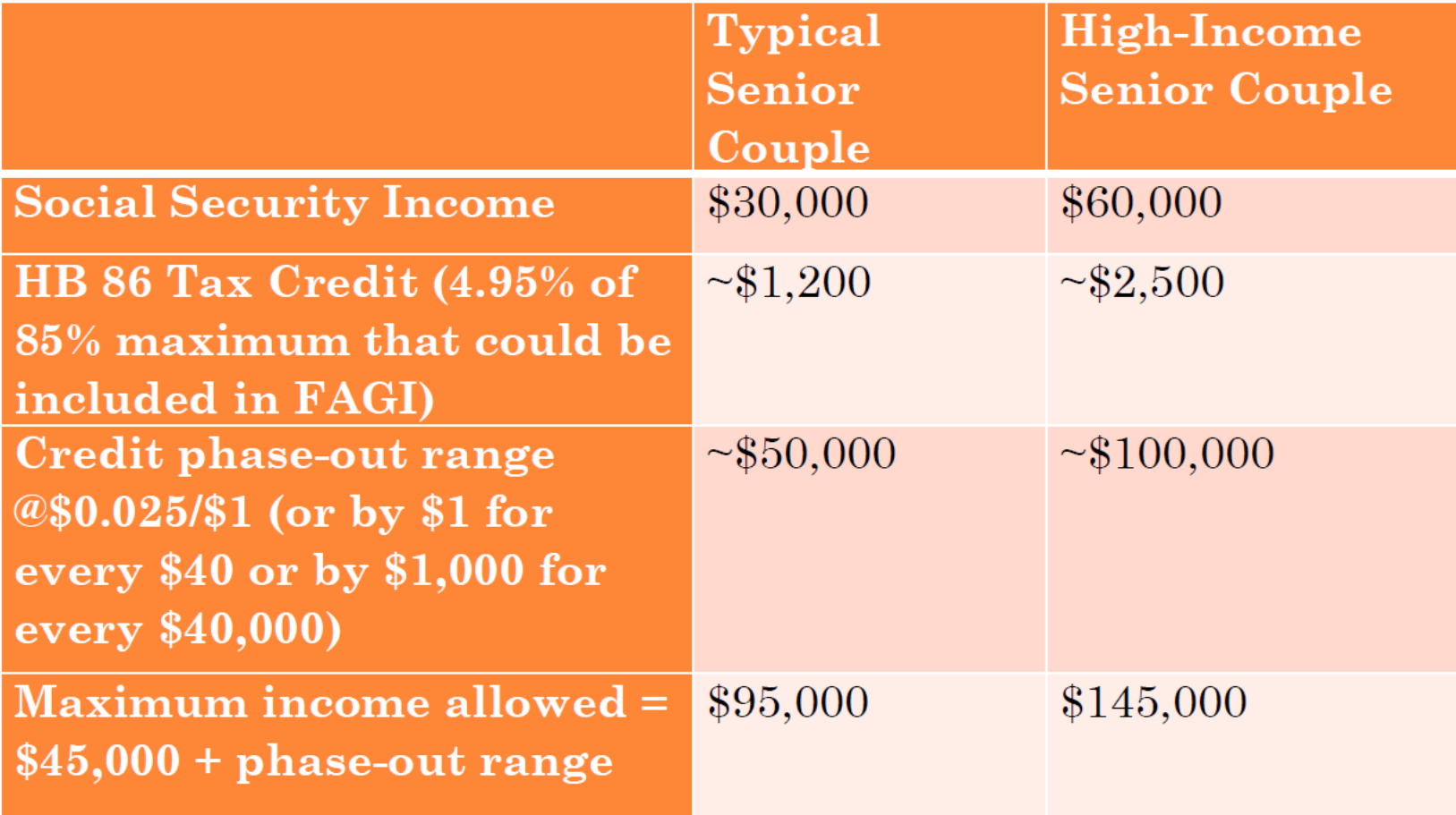

Voices For Utah Children Analysis Of Retirement Tax Credit Proposals Before The 2021 Utah Legislature

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must.

. The wage base limit is the maximum wage thats subject to the tax for that year. The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2023 will be 9932 147000 x 62 and 9114 147000 x 62 in year. If You Work More Than One Job Keep the wage base in.

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. For married couples filing jointly you will pay taxes on up to 50. The Social Security tax rate was 620 paid by the employee and 620 paid by the employer.

More than 44000 up to 85 percent of your benefits may be taxable. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021. Any income you earn beyond the wage cap amount is not subject to a 62 Social Security payroll tax.

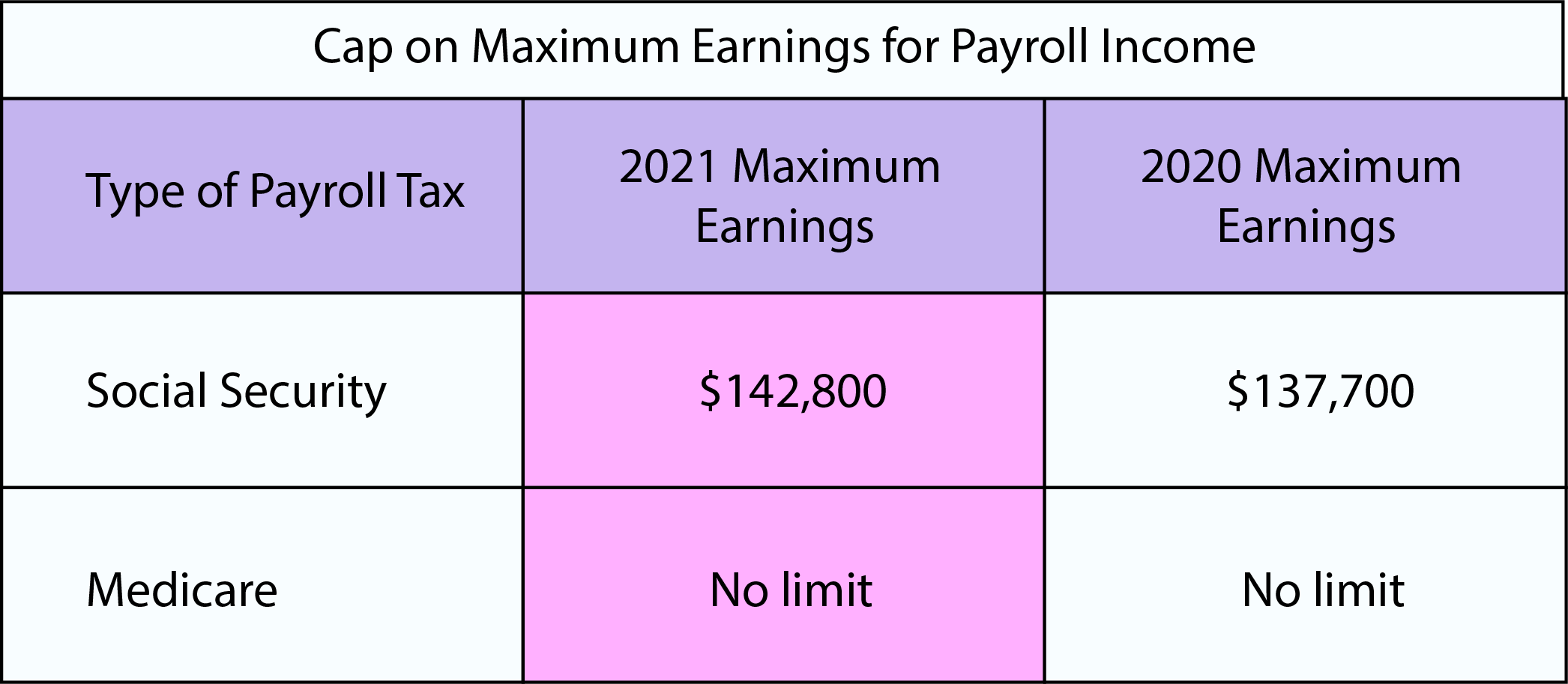

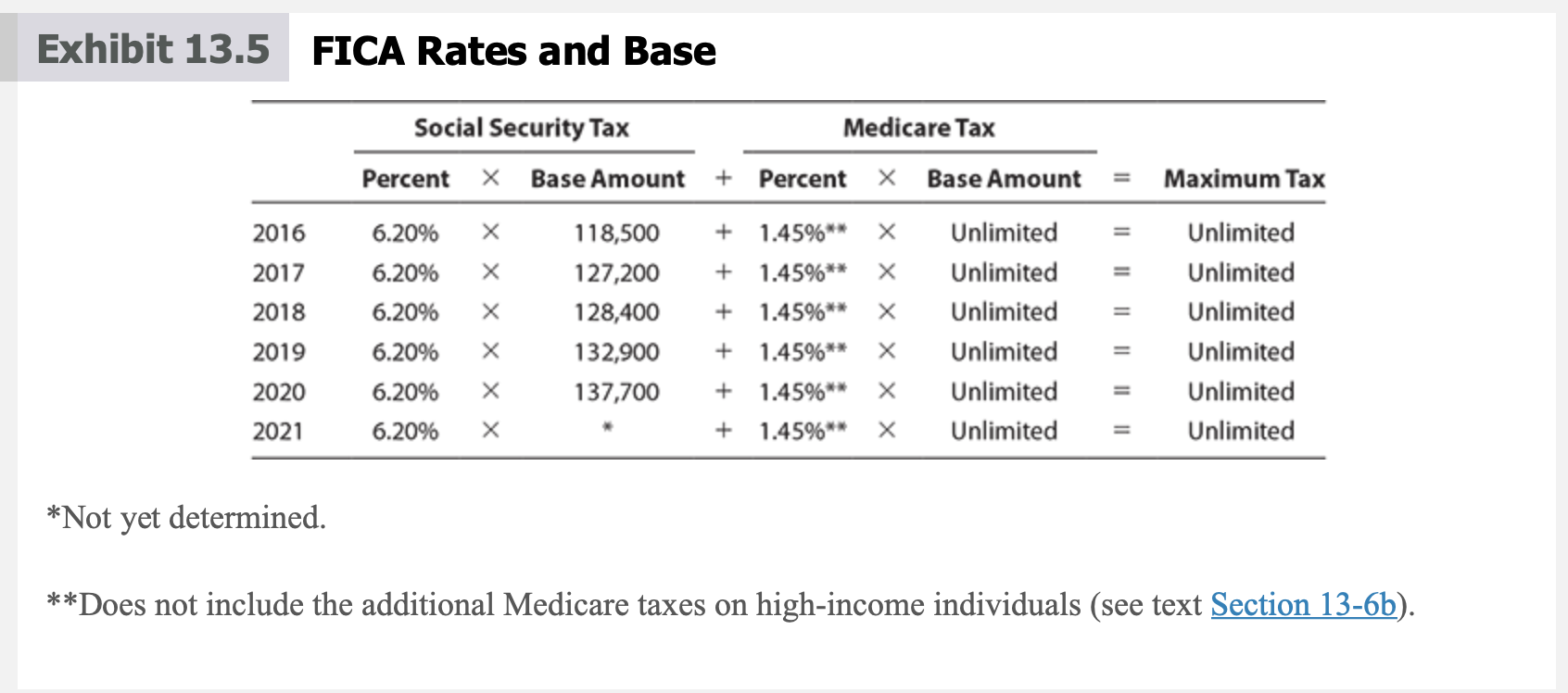

For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. This is the maximum amount of Social Security tax an employee will have withheld from their paycheck. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year.

The earnings limit on Social Security is not the same as income taxes on Social Security. 31240 Total Wages the Social Security Income Limit of 21240. The total of one-half of the benefits and.

For example an employee who earns 165000 in 2023 will pay 9932 in. By joseph June 15 2022. The maximum amount of income subject to Social Security tax is 142800 in 2021 up from 137700 in 2020You pay a Social Security tax of 62 on wages until your earnings hit the.

Generally up to 50 of benefits will be taxable. 9 rows This amount is known as the maximum taxable earnings and changes each year. Dont get the two confused.

In 2021 the Social Security taxable maximum is 142800. Earnings above this amount are not subject to Social Security tax or factored into Social Security payments in. The limit changes year to year depending on the national average wage.

For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. The Social Security taxable maximum is 142800 in 2021. For earnings in 2022.

Wage Base Limits Only the social security tax has a wage base limit. This is the largest increase in a decade and could mean a higher tax bill for some high earners. Workers pay a 62.

If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits. However up to 85 of benefits can be taxable if either of the following situations applies. What is the income limit for paying taxes on Social Security.

Your employer would contribute an. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. In 2020 the Social Security Wage Base was 137700 and in 2021 will be 142800.

In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

Social Security United States Wikipedia

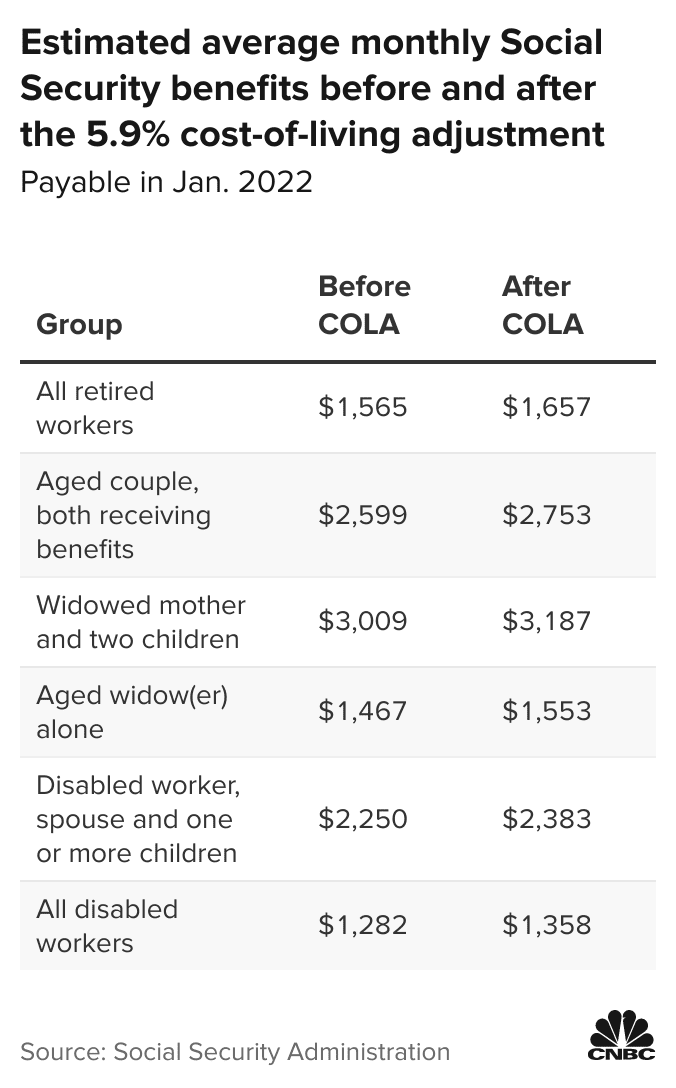

Getting Ready For Tax Season Cost Of Living Adjustment For 2021 And More Benefits Gov

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp

People Will Get Bigger Social Security Checks In 2022 How To Prepare

Social Diability Lawyer Social Disability Lawyer Blog Fica Taxes For Social Security Disability In 2021

Social Security Paychecks To Increase At Highest Rate In Nearly 40 Years Fox Business

Social Security Explained Conway Deuth Schmiesing Pllp

Taxable Social Security Wages Are Rising For 2021 Henry Horne

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Maximum Social Security Tax In 2021

What Is The Social Security Tax Limit For 2022 Gobankingrates

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

Social Security Increases For 2021 Flaster Greenberg Pc Jdsupra

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Solved In Each Of The Following Independent Situations Chegg Com

Tax Amount Increases For 2021 Trueblaze Advisors

What Is Fica Tax Contribution Rates Examples

What S The Maximum Social Security Tax In 2021 The Motley Fool

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

Comments

Post a Comment