pay past due excise tax chicopee massachusetts

Find your bill using your license number and date of birth. Jeffery and Jeffery is open 8-4 Monday thru Friday excluding major holidays.

On the 31st day interest will begin to accrue at 14 retroactive to the bill date.

. How do I pay my excise tax in Randolph MA. If you dont make your payment within 30 days of the date the City issued the excise. For our Online Bill Paying Service please click on the link below.

Payment is due within 30 days of the bill date not the postmark. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Massachusetts Motor Vehicle Excise Tax Information.

If you need more information please call the Collectors Office. Apply for a resident parking permit. Pay your motor vehicle excise tax.

The excise rate is 25 per 1000 of your vehicles value. If you are unable to find your bill try searching by bill type. WE DO NOT ACCEPT.

Payment at this point must be made through our Deputy Collector Kelley. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax. Request a birth certificate.

Overvaluation appeals are due within 30. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. If you do not fully pay a motor vehicle excise on or before its due date you also have to pay.

Online Payment Search Form. Pay your real estate taxes. Pay a parking ticket.

This information will lead you to The State. Drivers License Number Do not enter vehicle plate numbers. THIS FEE IS NON-REFUNDABLE.

You need to pay all of your taxes fees and interest on your account to avoid foreclosure. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. You must pay the excise within 30 days of receiving the bill.

Please note all online payments will have a 45 processing fee added to your total due. Click Here for Online Bill Paying Service. Interest 12 per year.

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Common payments and forms.

Not Just A Gas Tax Proposal To Pay For Massachusetts Transit Repairs Would Spread Cost Around Masslive Com

Economic Development Bill Awaits Gov Baker S Signature

Zoning Tools For Mixed Use Districts

Image 2 Of Revenue Stamp Duties Abstract Of The U S Excise Tax Laws Prepared For The Use Of Merchants Bankers Lawyers And The Public Generally Revenue Stamps Of Every Description Constantly

Massachusetts Recreational Consumer Council And Theory Wellness Partner To Host Expungement Event At Dispensary In Chicopee Ma Cannabis Business Times

Massachusetts 2020 Tax Litigation Summary

Tv489334 Def14a None 7 1841105s

Used Toyota S In West Springfield

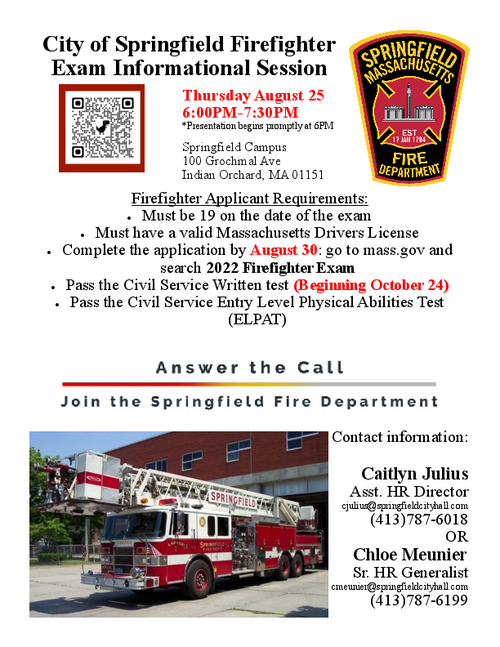

Pay City Taxes Fees Tickets Online City Of Springfield Ma

Massachusetts Recreational Consumer Council And Theory Wellness Partner To Host Expungement Event At Dispensary In Chicopee Ma Cannabis Business Times

/do0bihdskp9dy.cloudfront.net/08-23-2022/t_3f04d0269b0c40958f9b27044d93d9a1_name_file_1280x720_2000_v3_1_.jpg)

Alabama Auto Parts Maker Sued For Child Labor

Public Safety City Of Springfield Ma

Used Toyota S In West Springfield

Kic 255 7129 0239 091 Prod1 Policy Product Large

Excise Tax What It Is How It S Calculated

Watershops Pond Lake Massasoit Dam Upgrades Cdbg Disaster Recovery City Of Springfield Ma

Comments

Post a Comment