lincoln ne restaurant sales tax

Nearby homes similar to 2707 NW Columbine Dr have recently sold between 220K to 350K at an average of 145 per square foot. 3516 Anaheim Ct Lincoln NE 68506 504900 MLS 22218445 Welcoming you with 2500 square feet of top-end finishes where you will find three.

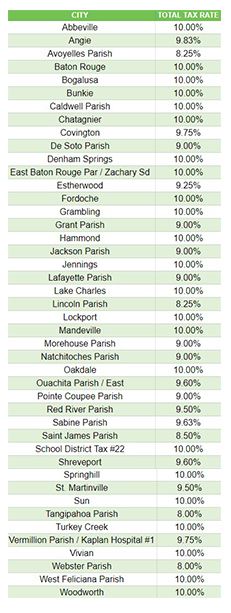

Nebraska Sales Tax Rates By City County 2022

If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email.

. What is the sales tax rate in Lincoln Nebraska. Lincoln NE Sales Tax Rate. Lincoln ne restaurant sales tax Tuesday March 1 2022 Edit.

Are there exemptions for the City of Lincoln Restaurant Bar Occupation Tax. This includes the rates on the state county city and special levels. The Nebraska state sales and use tax rate is 55 055.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Lincoln is located within Lancaster County Nebraska. The average cumulative sales tax rate in Lincoln Nebraska is 688.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. SOLD MAY 31 2022. 300000 Last Sold Price.

Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or seven cents on the dollar to. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. This is the total of state county and city sales tax rates.

If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at 402 441-7457 or use our email. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. 3 beds 3 baths 2560 sq.

This page describes the taxability of. While Nebraskas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Occupation tax shall be imposed on the gross receipts resulting from the sales of food within.

The current total local sales tax rate in Lincoln NE is 7250. The December 2020 total local sales tax rate was also 7250. If you have any questions please call the Lincoln City Treasurer Monday thru Friday from 800 am to 430 pm at.

The Nebraska state sales and use tax rate is 55 055.

Is Food Taxable In North Carolina Taxjar

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Witherbee Neighborhood Association Lincoln Nebraska

Sales Tax By State To Go Restaurant Orders Taxjar

New Truth In Taxation Postcards Creating Confusion For Property Taxpayers In Lancaster County

Missouri Sales Tax Rate Rates Calculator Avalara

Here S What Happens To Your Sales Tax Gobankingrates

Nebraska Sales Tax Small Business Guide Truic

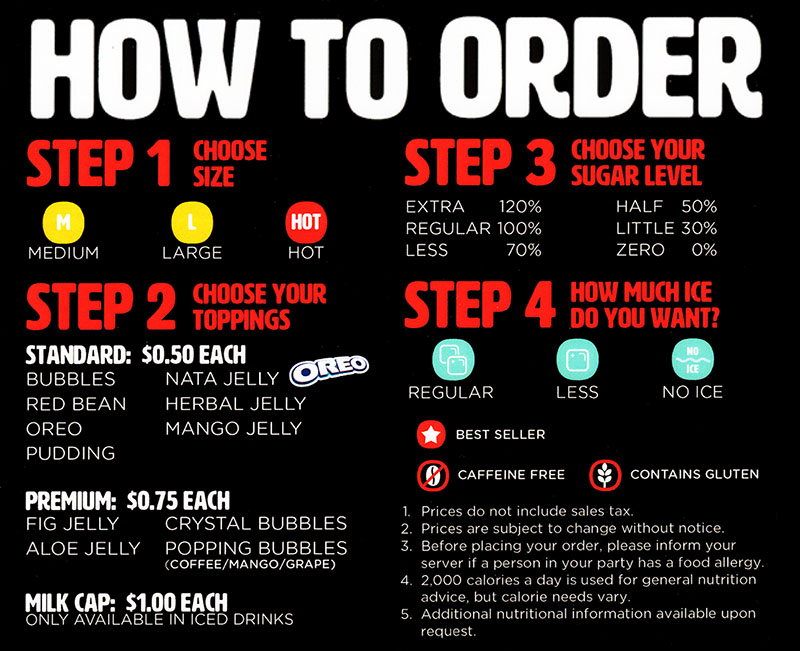

Kung Fu Tea Menu Order Online Delivery Lincoln Ne Bubble Tea City Wide Delivery Metro Dining Delivery

Nebraska Income Tax Ne State Tax Calculator Community Tax

Jimmy John S 1541 N 86th St Lincoln Ne Yelp

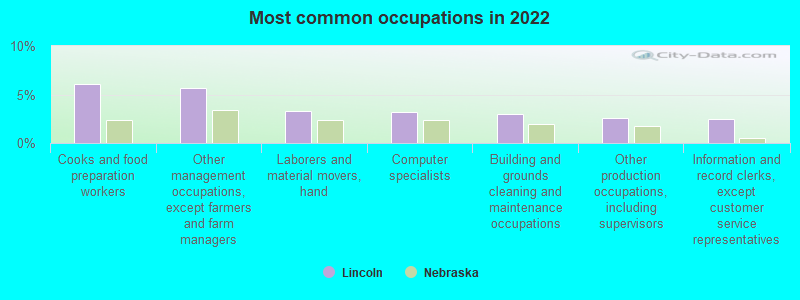

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mayor Working To Share Information About Losst Extension Vote Knia Krls Radio The One To Count On

Comments

Post a Comment